Dupont formula roi

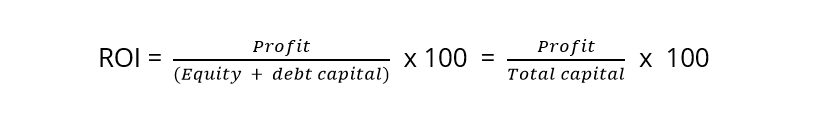

We now have all the required inputs to calculate ROE using both the 3-step and 5-step DuPont approaches. The basic formula looks like this.

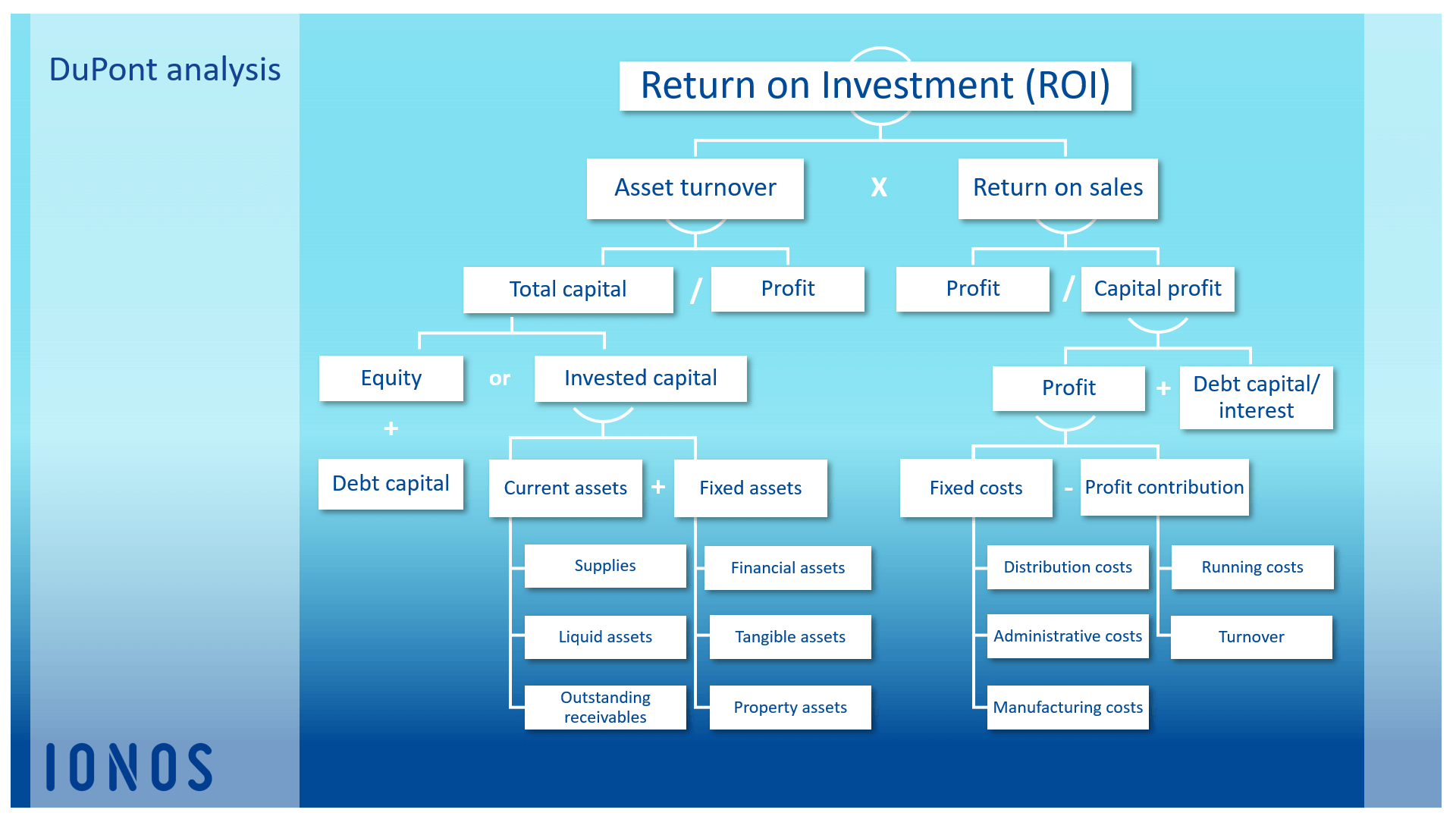

Roi Return On Investment Definition Formula Calculation Ionos

The name comes from the DuPont Corporation that started using this formula in the 1920s.

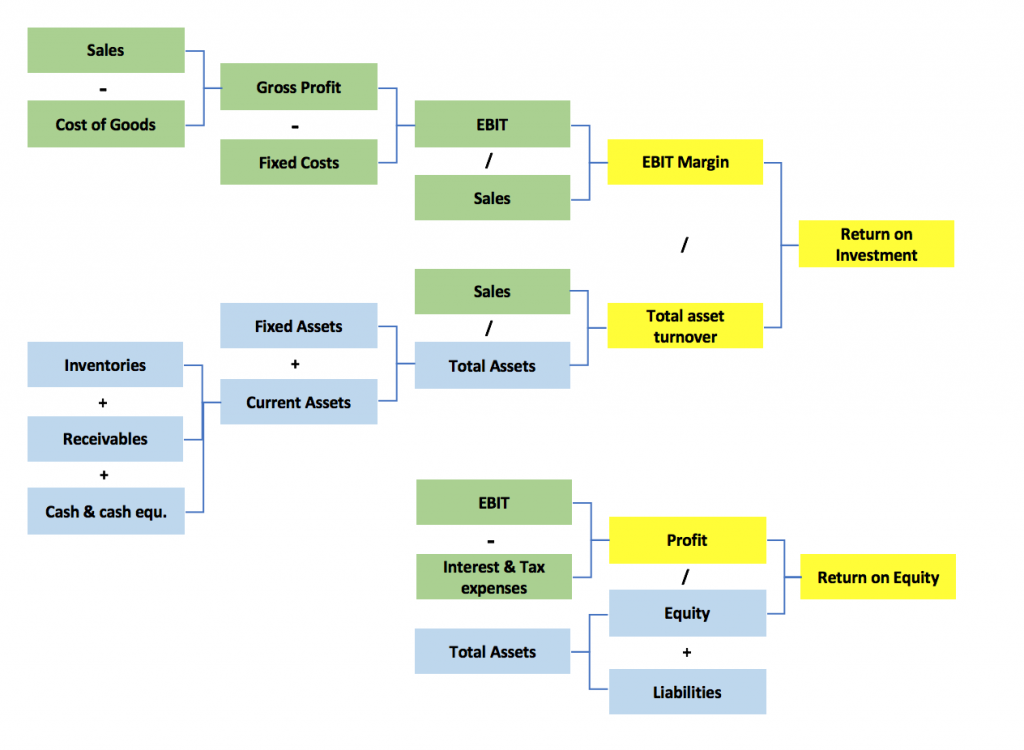

. DuPont analysis is an expression which breaks ROE Return On Equity into three parts. ROE Profit Sales Sales Assets Profit Assets Assets Equity Or ROE ROSAT ROALeverage ROE analysis edit The DuPont analysis breaks down ROE that is the returns. That is what the DuPont Equation achieves.

DuPont ROE Example Calculation. Since each one of these factors is a calculation in and of. Formula The Dupont Model equates ROE to profit margin asset turnover and financial leverage.

ROE year one 180000 300000 x 300000 500000 x 500000. Return on Investment ROI can be calculated using the DuPont formula. Asset use efficiency 3.

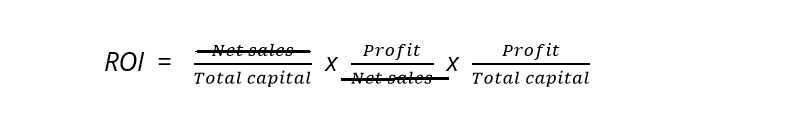

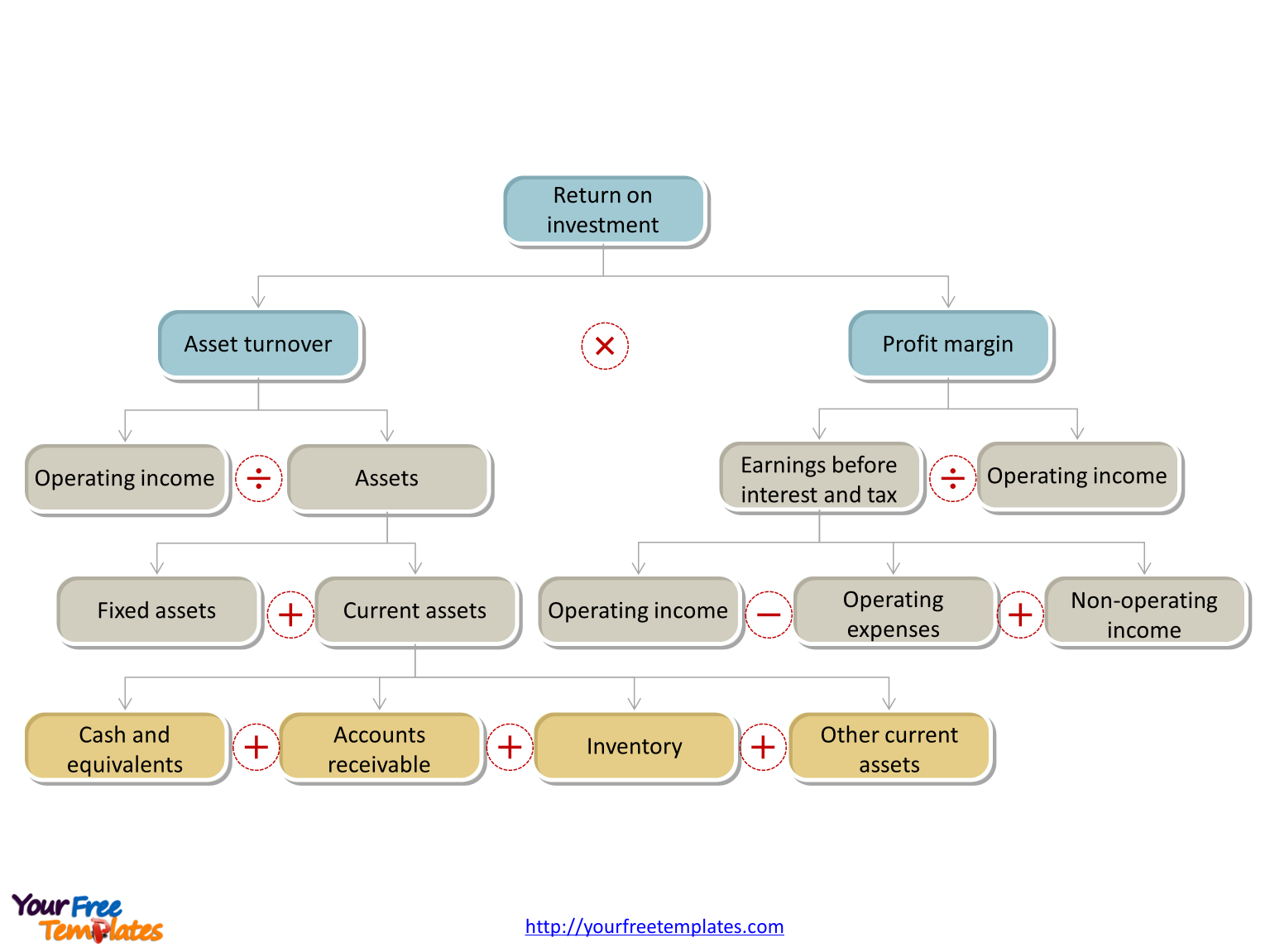

Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage. In order to calculate the ROI we must first determine the companys return on sales. This website may use.

It uses the net profit margin and total asset turnover in the calculation of ROI. The Three Component Dupont Formula This formula observes that ROE can be broken out into three key contributing factors ROE or EarningsEquity EarningsSales x SalesAssets x. To calculate the ROE under the 3-step approach we.

Operating efficiency asset efficiency and leverage. This works because when you. Calculation formula ROE DuPont formula Net profit Revenue Revenue Total assets.

The DuPont Equation says that Return on Equity Profit Margin Asset Turnover Financial Leverage. 28 million dollars. To do this we must first divide the profit by the net sales then.

Nor are many of them familiar with the origins of ROI namely the Du Pont formula created in the early 20th century at the Du Pont powder company in Wilmington Delaware. Company ones DuPont analysis ROE 025 x 16 x 25 1 Company twos DuPont analysis ROE 0125 x 25 x 8 25 Using the DuPont analysis model allows the. Using the DuPont identity the ROE for each year is.

Year two shareholder equity 980000. By splitting ROE return on equity into three parts companies. So I thought Id lay.

The basic DuPont Analysis model is a method of breaking down the original equation for ROE into three components.

Dupont Analysis Roe Formula Breakdown And Calculator Excel Template

Free Dupont Analysis Template Free Powerpoint Template

Roi Return On Investment Definition Formula Calculation Ionos

Du Pont Roi Graphic

Dupont Analysis Wikiwand

Value Creation And Fp A The Dupont Analysis Fp A Trends

Roi Return On Investment Unigiro Regtech

Roi Return On Investment Definition Formula Calculation Ionos

Dupont Formula And Equation Dupont Analysis

Free Dupont Analysis Template Free Powerpoint Template

Roi Return On Investment Definition Formula Calculation Ionos

Free Dupont Analysis Template Free Powerpoint Template

The Du Pont Return On Investment Formula Johnson And Kaplan 1987 The Download Scientific Diagram

Dupont Roi Analysis Mba Boost

Dupont Analysis Roe Formula Breakdown And Calculator Excel Template

Martin S Management Accounting Textbook Chapter 14

The Dupont Roi Model Investing Inventory Sale Back To Work